Which of the Following Describes a Contributory Group Insurance Plan

All of the following factors are used in the needs approach for determining the amount of required life insurance. Group life insurance plans in which the employer pays the entire premium is called a Noncontributory plan.

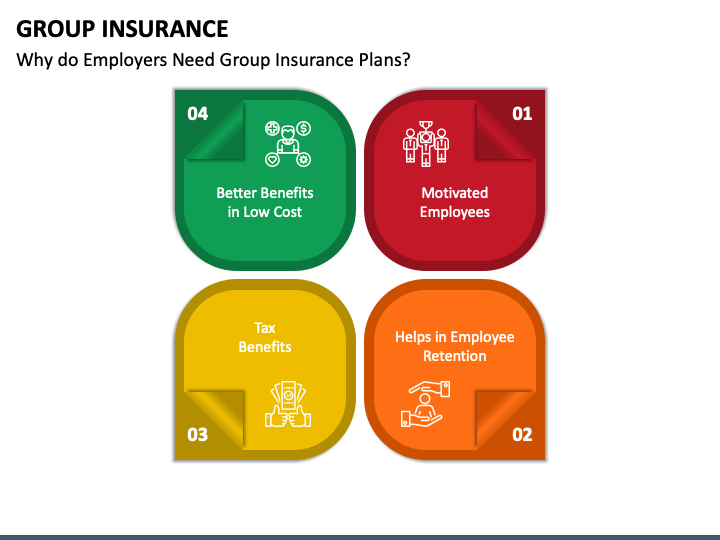

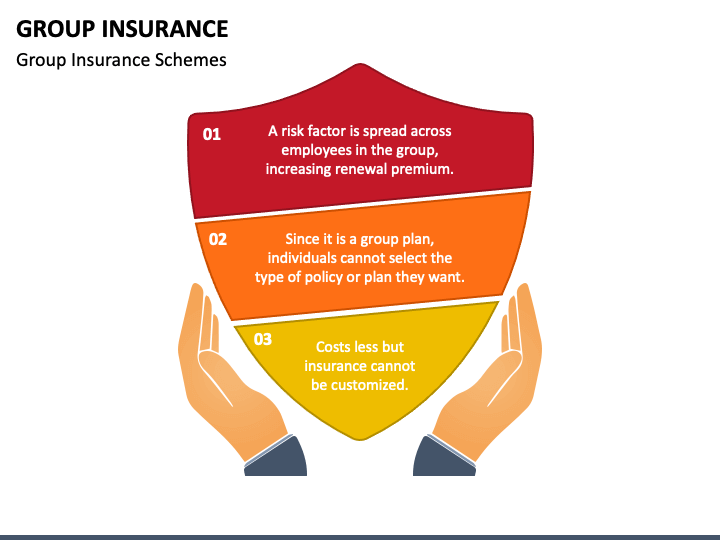

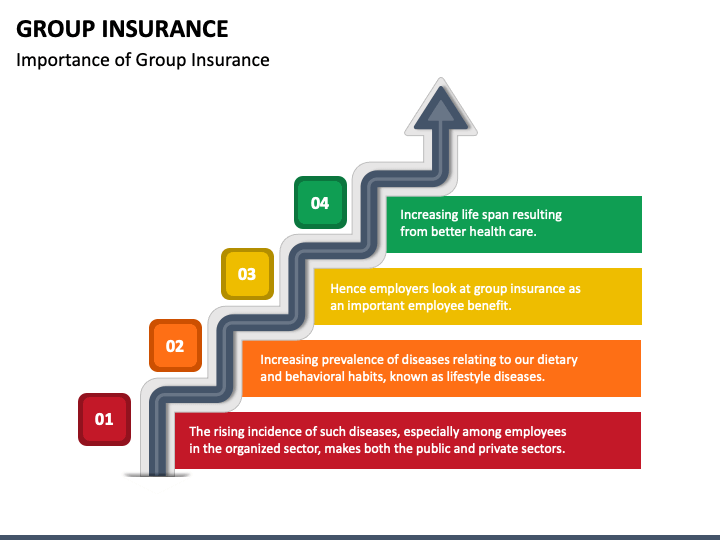

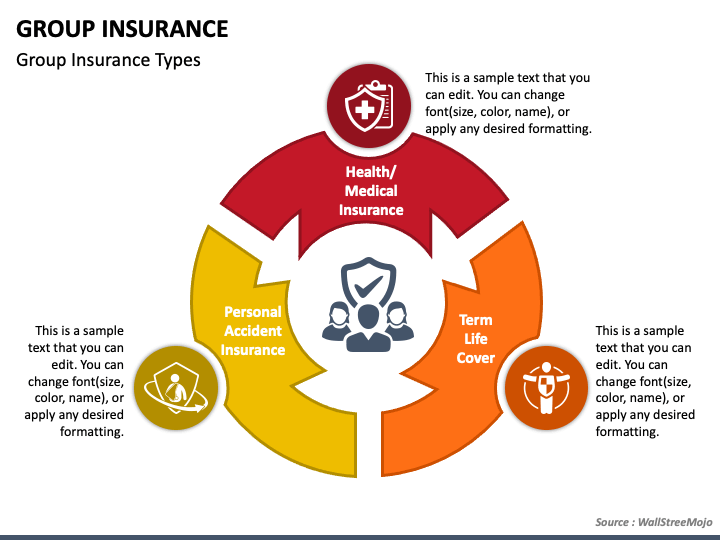

Group Insurance Powerpoint Template Ppt Slides Sketchbubble

In most states when a group life insurance plan is written on a contributory basis the group plan must insure at least ______ of all eligible group members.

. 13 - Health Accident. Which of the following describes a contributory Group insurance plan. 1 richer after retirementat least until recently.

There is a break in coverage of more than 53 days. Contributory- Group life insurance plans are those in which the employee contributes a portion of the premium and the employer pays the rest. Employers have the option of contributing to the employees premium.

Part of the premium is paid by the employee. At the time she surrendered the contract the account value was 180000 and her tax. Contributory P is a new employee and will be obtaining non contributory group major.

The monthly income the emergency fund period the education fund. Under HIPAA requirements eligibility for the pre-existing conditions exclusion waiver under new coverage is lost if. Richard has worked at JJ Printing Inc.

When an employee is required to pay a portion of the premium for an employer employee group health plan the employee is covered under which of the following plans. Group life insurance plans in which the employee contributes a portion of the premium is called a Contributory plan. This means they are members of a.

All of the following are considered characteristics of group life insurance EXCEPT. Part of the premium is paid by the employee. Group life insurance plans in which the employer pays the entire premium is called a Noncontributory plan.

There is a break in coverage of more than 33 days. In a non-contributory plan the employers cover the full costs of the premiums on behalf of the employees. Asked Nov 5 2021 in Psychology by NightOwl.

There is a break in coverage of more than 43 days. These plans have varying coverage plans premium payments and deductibles as well as different benefits and eligibility requirements for. In a contributory insurance plan employees contribute a portion of group insurance premium.

A method of marketing group benefits to employers who have a small number of employees is the. Which of the following is NOT a characteristic of a non-contributory group life insurance. Noncontributory- Group life insurance plans are those in which the employer pays the entire premium and the employee supplies no portion of the premium costs.

Put the following nations in the correct order. Group life insurance plans in which the employee contributes a portion of the premium is called a Contributory plan. The insurance company evaluates the group as a whole instead of individuals within a group and then measures the groups risk against it underwriting standards.

The employees of Ace Trucking company must each pay a portion of the premium for their group insurance. About 9 out of 10 current pension plans are funded on a contributory basis. Which of the following describes the number of deaths in a year compared to the number of people in a select group.

Which of the following is. 2 no government-funded retirement. Policies that cover a group of people exposed to a common hazard.

On a CGL the policy provision that applies to a claim that occurred during the policy period. 3 basic or minimal government assistance but not much more. Which of the following describes a contributory group insurance plan.

All of these are examples of a business use for life insurance. A type of group that has a constitution and bylaws and has been organized for purposes other than obtaining insurance is called a n association or labor group. A school teacher has contributed 80000 into a Tax Sheltered Annuity.

For the past three months and wants to join the companys contributory group insurance plan. All of the following are characteristics of a Worksite Plan in health insurance except. They require the employer to pay all of the premiums.

The Florida Workers Compensation Case Process Worker Compensation Process

Types Of Social Protection Gsdrc

Group Insurance Powerpoint Template Ppt Slides Sketchbubble

Cheap Health Insurance Tampa Fmfinancial Group Cheap Health Insurance Best Health Insurance Health Insurance Companies

Group Insurance Powerpoint Template Ppt Slides Sketchbubble

Group Insurance Powerpoint Template Ppt Slides Sketchbubble

Group Insurance Types Of Group Insurance Plans In India

Contractor Insurance Certificate Requirements Checklist Template For Ms Word Checklist Template Ms Word Words

10 Reasons To Quit Sugar An Infographic Health Tips Sugar Infographic Health Info

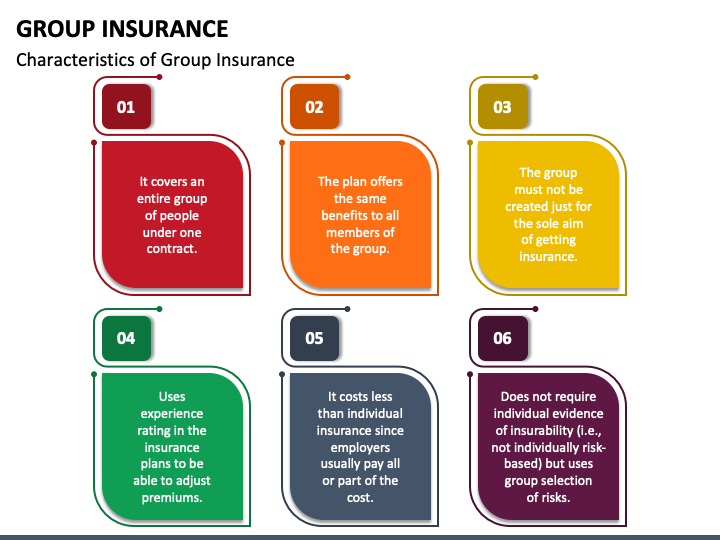

Circle The Correct Answer 13 11 Most Group Life Chegg Com

Magura Group Limited Job Circular 2020 Bdjobsfeed Job Circular Time Management Skills Company Job

Group Insurance Powerpoint Template Ppt Slides Sketchbubble

Group Insurance Types Of Group Insurance Plans In India

Group Insurance Powerpoint Template Ppt Slides Sketchbubble

Comments

Post a Comment